What is an example of investing time?

You can use your time in such a way that it is an investment. That is, you are giving away something now with a view to recouping something greater later. Think about the time you invested in learning how to read when you were a child. Think about the time you invested in your legal career.

An investment time horizon is the time period where one expects to hold an investment for a specific goal. Investments are generally broken down into two main categories: stocks (riskier) and bonds (less risky). The longer the time horizon, the more aggressive, or riskier, a portfolio an investor can build.

For example, someone who begins investing at age 25 and would like to retire by 65 would have an investment time horizon of 40 years. If they are 35 and would like to leave the workforce by 70, they have 35 years to build that investment income for their golden years.

This means you invest your personal time as a leader to focus on your people by engaging with them daily, counseling or coaching and growing them and helping them to attain their goals and identify and live out their passions.

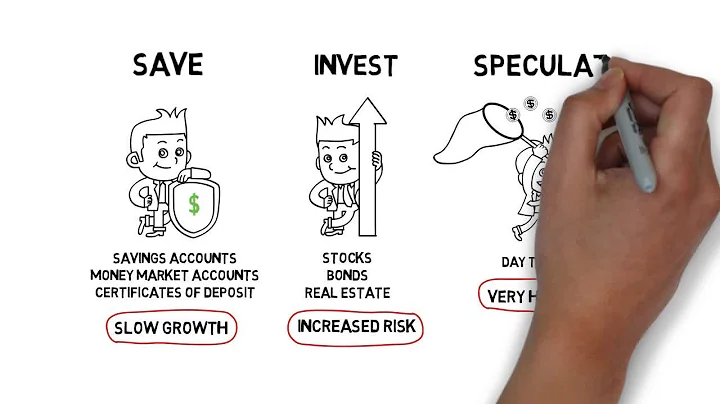

There are many types of investments to choose from. Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds. Other types of investments to consider are real estate, CDs, annuities, cryptocurrencies, commodities, collectibles, and precious metals.

Spending your time shows that you need to get maximum things done, invest your time in making you future proof or creating a system or pattern that would save you hours and create more hours in the time to come.

By investing time into your finances, you can enhance communication and teamwork with your partner, family members, or business associates, fostering healthier and more harmonious relationships. 6. Future Generational Benefits: By managing your finances wisely, you not only benefit yourself but also future generations.

Your investment time horizon is the length of time you need your retirement assets to work for you. Your average life expectancy is a good starting point when determining your investment time horizon, but relying on average life expectancies can underestimate how long you will likely live.

On one end, place your age as of today; on the opposite end, identify your target age when you hope to achieve your most distant investing goal: for many people, this is retirement. The intervening years between these two ages is the time horizon you have for that future target.

Common time horizons

Investment time horizons can generally be broken down into three categories: short-term, mid-term, and long-term.

What is a synonym for invest time?

synonyms. 53 other terms for invest time. spend time. v. devote time.

The phrase "invest a lot of time and effort" is correct and usable in written English. It is often used to describe activities that require significant energy and resources in order to be successful. For example, "I am investing a lot of time and effort into my studies in order to achieve the best possible grades.".

- Stock market investments. ...

- Real estate investments. ...

- Mutual funds and ETFs. ...

- Bonds and fixed-income investments. ...

- High-yield savings accounts. ...

- Peer-to-peer lending. ...

- Start a business or invest in existing ones. ...

- Investing in precious metals.

Investing is when you buy something in hopes that it'll appreciate (aka increase in value) or generate income. People can invest in many ways, from buying gold or real estate to putting money toward building businesses and furthering their education.

Experts suggest investing 15% of your income each month, and more if you can afford to. However, if 15% is out of your budget right now, you should still invest what you can afford. Look to reduce your expenses to free up more money and invest more when it's feasible.

In general, you should save to preserve your money and invest to grow your money. Depending on your specific goals and when you plan to reach them, you may choose to do both. “When deciding whether to save or invest your money, it is essential to prioritize determining when you will need it,” says Maizes.

The key is in not spending time, but in investing it – Stephen Covey Treating time as a resource that can be invested – Focus inward and try to find out which investment can give you the most value Being mindful of where your time is being spent.

Suppose you're starting from scratch and have no savings. You'd need to invest around $13,000 per month to save a million dollars in five years, assuming a 7% annual rate of return and 3% inflation rate. For a rate of return of 5%, you'd need to save around $14,700 per month.

1. : to commit (money) in order to earn a financial return. 2. : to make use of for future benefits or advantages.

If you put off investing in your 20s due to paying off student loans or the fits and starts of establishing your career, your 30s are when you need to start putting money away. You're still young enough to reap the rewards of compound interest, but old enough to be investing 10% to 15% of your income.

Is $1 m enough to retire at 60?

Will $1 million still be enough to have a comfortable retirement then? It's definitely possible, but there are several factors to consider—including cost of living, the taxes you'll owe on your withdrawals, and how you want to live in retirement—when thinking about how much money you'll need to retire in the future.

Bottom Line. With $100,000 you should budget for a retirement income of around $5,000 to $8,000 on top of Social Security, depending on how you have invested your money. Much more than this will likely cause you to run out of money within 25 – 30 years, which is potentially within the lifespan of the average retiree.

Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

In a less-risky investment such as bonds, which have averaged a return of about 5% to 6% over the same period, you could expect to double your money in about 12 years (72 divided by 6).

As an investor, selecting and adhering to your chosen asset allocation is job number one. Before you decide to buy an investment, ask yourself, "Will stock XYZ or fund ABC fit into my asset allocation and provide enough potential growth to justify its risk?" If not, it's not the investment for you.